Nearly 67% of people have thought about switching careers in the past year, according to a 2020 report from iHire, a platform that brings job seekers and employers together. Career switching is an emerging trend, and a finance career may be worth considering.

Wharton Online’s Asset and Portfolio Management Certificate Program was designed for aspiring portfolio managers and career switchers to learn about investment products, risks, and strategies. This guide answers questions about the certificate program’s formats, coursework, online learning environment, length, and more.

How Many Courses Are in the Program?

The 100% online, self-paced Asset and Portfolio Management Certificate Program consists of three investment portfolio management courses. Each course is detailed below.

- Fundamentals of Portfolio Management: Focuses on foundational aspects of portfolio management, such as regulation, diversification, the modern portfolio theory, and different investment strategies

- Investment Products: Helps expand your understanding of investment products—such as derivatives, bonds, and mortgage-backed securities—to enhance ROI strategies

- Asset Allocation: Discusses the capital asset pricing model and other frameworks for assessing short- vs. long-term risks and returns for various investments

Each of these online investment courses consists of four modules that you’ll have on-demand access to.

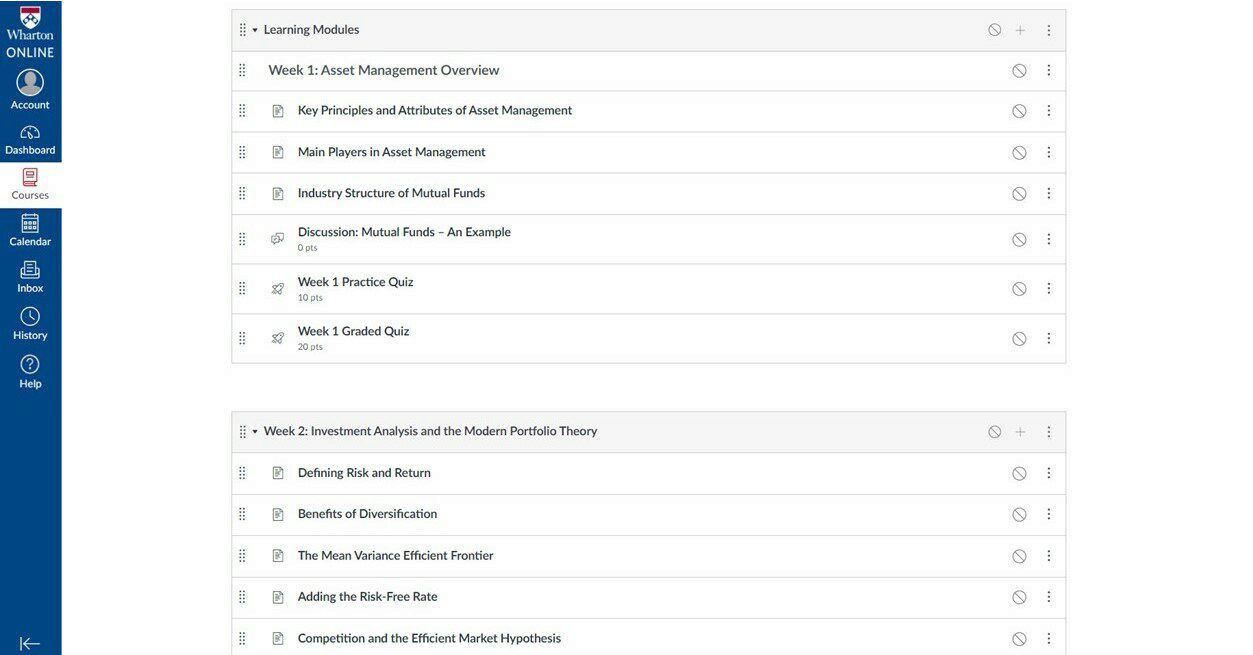

What’s the Coursework Like?

Before starting Wharton’s investment portfolio management courses, you have to complete a profile and introduce yourself to fellow learners in the discussion forum. You can explain your professional background, new careers you’re considering, and some of your personal hobbies.

Beyond those preliminary steps, here’s what you can expect from each course:

- Video lectures

- 10-question practice multiple choice quiz to prepare for the module exam

- 20-question graded multiple choice exam at the end of each module

- Discussion forum

- Short exercises in some modules

- Final case study at the end of each course

Quizzes

Module quizzes test your knowledge of key topics. The practice quiz is designed to prepare you for the graded quiz, which requires an 80% score to pass.

Discussion forum

The discussion forum is a great place to interact with your fellow learners. You may use it to ask questions about course material, share a relevant resource, or get advice about a career change you’re considering. Some course modules require you to share one original post and comment on at least one person’s post in the discussion forum.

Final case study

Each of the investment portfolio management courses ends with a case study based on a financial scenario. The case study assignment consists of a spreadsheet for data analysis and 21-question quiz; to pass, you must submit the spreadsheet and answer at least 17 quiz questions correctly.

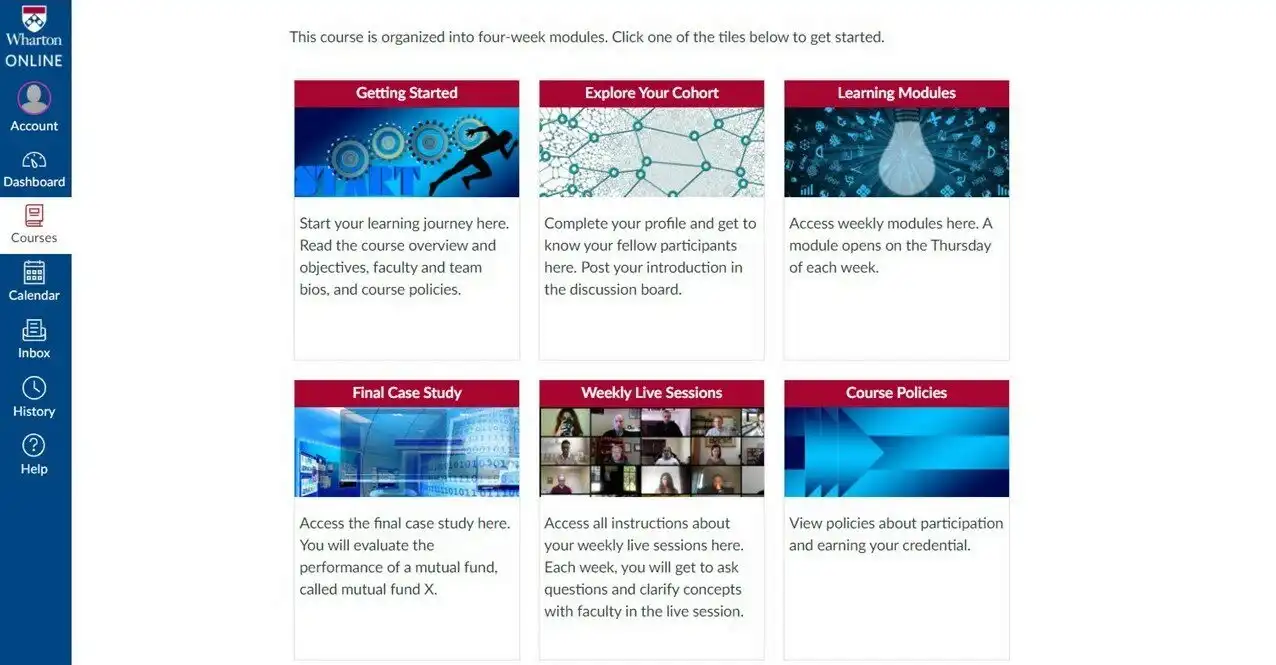

What’s the Online Classroom Like?

We use a very intuitive online learning platform for our Asset and Portfolio Management Certificate Program. The program also features recent design changes for a more sophisticated look and feel.

The navigation panel can be found on the left side of your screen and includes these sections:

- Account

- Dashboard

- Courses

- Calendar

- Inbox

- History

- Help

You can access your investment portfolio management courses in the “Courses” section.

Within “Courses,” the main sections are:

- Getting Started

- Explore Participants

- Learning Modules

- Final Case Study

- Course Policies

You’ll spend most of your time in the “Learning Modules” section progressing through the course material.

The “Learning Modules” section houses course video lectures and quizzes.

What Happens if I Have Technical Issues?

For technical support, click on the “Help” section of the navigation panel. The Wharton Online team is committed to quickly resolving technical issues.

Can I Get in Touch With My Course Facilitator?

Yes. Your course facilitators’ contact information is available through the online learning portal.

How Long Does the Program Take?

Short answer: It depends. Our program is offered in a self-paced format, which means you have the flexibility to complete course material as quickly or as or slowly as you’d like. On average, each online investment course takes about four weeks to complete, which means the full program may take about three months to complete.

After enrolling in the course, you will have on-demand access to all the course materials and will be able to advance through the program at your own pace. The estimated time commitment is three to five hours per week. Based on this, each course will take about four weeks to complete. However, it may take you more or less time to complete each course depending on how much time you spend on your studies each week. For online learning time management insights, check out our article, “10 Tips for Learning Online.”

Learn More About Our Asset and Portfolio Management Certificate Program

If you’re ready to take the next step toward a new career, our investment portfolio management courses can help. You can enroll in our self-paced program anytime. Learn more about our Asset and Portfolio Management Certificate Program, or request more information today.

Download our eBook: Work-Life Balance for Finance Professionals

Finance careers can be fast-paced and exciting, but the long hours and heavy workloads can lead to considerable stress. Download our free eBook, “Work-Life Balance for Finance Professionals”, to learn about the causes and symptoms of work-related stress in the finance field, and how to create a healthier work-life balance.